A credit score is a numerical representation of a person’s creditworthiness, reflecting how likely they are to repay borrowed money. This score is crucial for lenders, landlords, and even some employers when deciding whether to extend credit, approve rental applications, or offer job positions.

What Is a Credit Score?

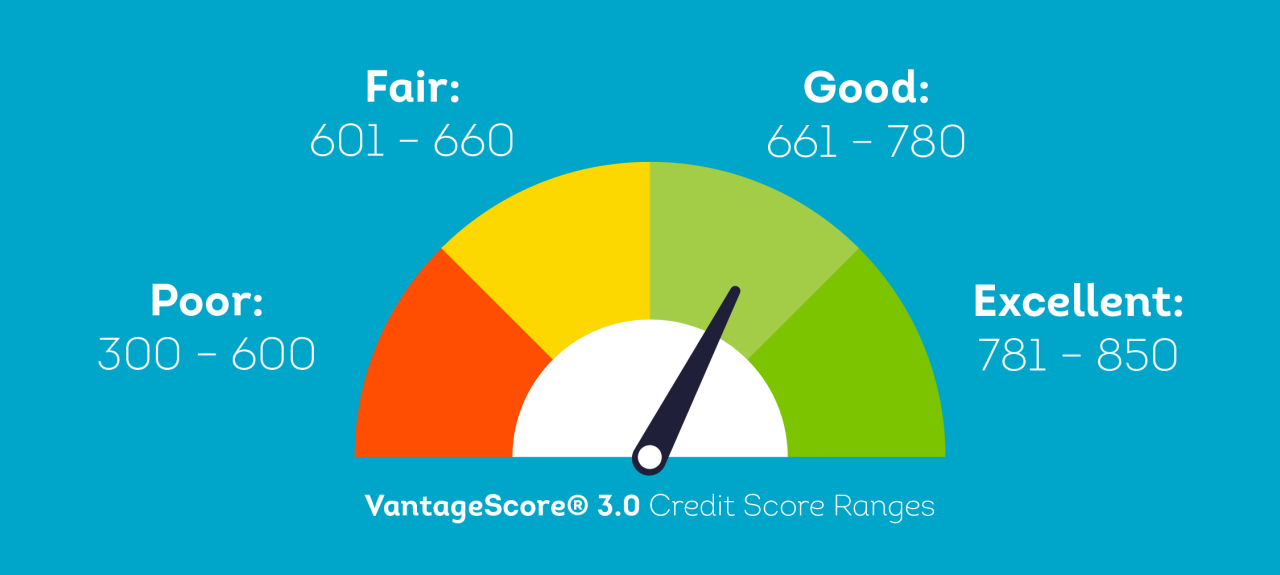

Credit scores typically range from 300 to 850, with higher scores indicating better credit health. These scores are calculated based on information in your credit report, including your payment history, amounts owed, length of credit history, new credit inquiries, and types of credit used.

Credit Score Ranges:

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800–850: Excellent

Why Is Your Credit Score Important?

- Loan Approvals: A higher score increases your chances of getting approved for credit cards, auto loans, mortgages, and more.

- Interest Rates: Good credit can help you qualify for lower interest rates, saving you money over time.

- Rental Applications: Landlords may check your score to assess reliability as a tenant.

- Job Applications: Some employers review credit reports (though not scores) for certain financial or security-related roles.

How to Improve Your Credit Score

- Pay bills on time: Payment history is a major factor.

- Reduce debt: Keep your credit utilization below 30%.

- Limit new credit inquiries: Too many applications in a short time can hurt your score.

- Maintain old accounts: The length of your credit history matters.

- Check your credit report: Review for errors and dispute inaccuracies.

TechOldNewZin | Bridging the Gap Between Past, Present, and Future Technology

Final Thoughts

Your credit score is more than just a number—it can shape your financial future. By understanding what affects it and taking steps to maintain or improve it, you can unlock better opportunities for loans, housing, and more.